Ang mga Fees at Rules sa pag-iinvest sa Philippine Stock Market Ngayong handa ka ng mag-invest sa stocks, kinakailangan mo rin malaman kung ano-ano ang mga rules ng PSE pag dating sa trading at ang mga kaukulang fees sa pag-trade ng stocks.

Ano ang minimum board lot?

Ang board lot table ay nagsasaad ng minimum na bilang ng shares na kinakailangan mong bilhin upang makapag-trade ka ng stocks. Ito ay nakadepende sa market price ng stock sa oras na ito’y iyong bilhin o ibenta.

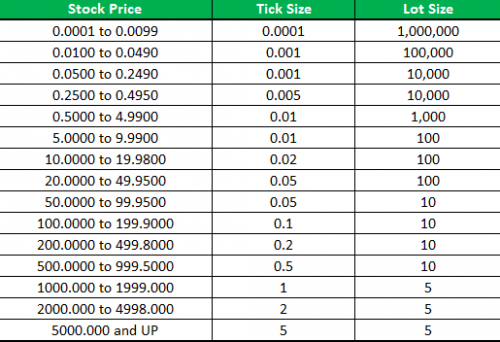

Nasa ibaba ang itsura ng isang board lot table.

Isang halimbawa nito ay kung nagdesisyong kang bumili ng BDO stocks sa araw na iyon. Kung ang stock price para sa oras ng pagbili mo ay nagkakahalaga ng 96 pesos kada share. Makikita sa board lot table sa itaas na ang minimum na bilang ng shares na kinakailangan mong bilhin upang makapag-trade nito ay 10 shares (Lot size).

Ang tick size naman ay nagsasaad ng minimum na paggalaw ng stock price. Halimbawa para sa stock price na nagkakahalga ng 1000 pesos kada share, ang minimum na paggalaw o pagbabago sa presyo ng stocks ay mula 1000 pesos hanggang 1001 dahil ang tick size nito ay 1. Isa pang halimbawa ay kung kung ang kada share ay nagkakahalaga ng 10.50 pesos. Ang minimum increment o paggalaw nito ay 10.50 hanggang 10.52 kung ito’y pataas at 10.48 naman kung ito’y pababa dahil sa tick value nito na .02

Ano-ano ang mga fees na kailangang bayaran sa pagbili o pagbenta ng stocks?

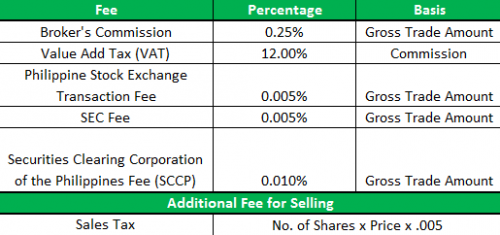

Nakasaad sa table sa ibaba ang mga fees na kinakailangang bayaran sa pagbili at pagbenta ng stocks.

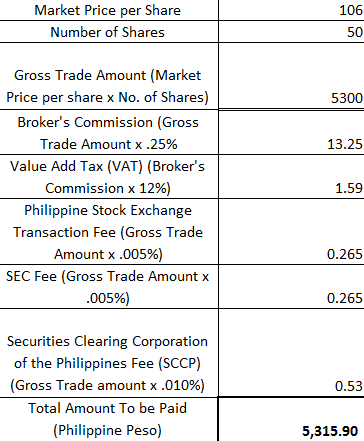

Halimbawa nito ay nagdesisyong bumili si OFW ng 50 shares ng BPI stocks na nagkakahalaga ng 106 pesos kada share sa oras na iyon. Ang magiging computation ng kanyang babayaran para sa pagbili ng stocks ay ang sumusunod.

Ang broker’s commission ay ang bayad sa stock broker para sa kanyang serbisyo sa pag-eexecute ng trade sa stock exchange.

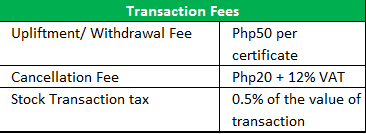

Ang iba pang mga fees na maaari mong bayaran sa stocks ay ang mga sumusunod:

Ang uplifment fee o withdrawal fee ang tawag sa babayaran mo kung gusto mong iissue ang stock certificate sa pangalan mo. Sabihin lang sa iyong broker ang iyong request at ito’y kanilang ipapadala sa PDTC system na siya naming mangangasiwa ng stock certificate.

Ang cancellation fee naman ang bayad para sa pagkansela ng stock certificate na nakapangalan sa iyo sa PDTC sytem kapag iyong ibebenta na ang stocks.

Sa susunod kong article, akin naman tatalakayin ang konsepto ng realized at unrealized gains and losses sa stocks at ang iba pang mga kaaalamang dapat malaman mo pagdating sa stock investments.

History has proven that investing in quality stocks can provide greater returns than most investment instruments. This offers an ordinary Pinoy investor, overseas Filipino worker the best chance in achieving financial goals and gives you the ability to later enjoy the benefits of their money.

Nevertheless, making money in the stock market (equities) is not easy. It not only requires a lot of patience and discipline, but also a great amount of research and a good understanding of the market, among others. Remember that you should always avoid following the crowd if you don't want to lose your hard-earned money in stock markets. The world's greatest investor Warren Buffett was wise when he said, 'Be fearful when others are greedy, and be greedy when others are fearful.' Don’t try to time the market. Catching the tops and bottoms is a myth. More people have lost far more money than people who have made money. A lot of investors lose money in stock markets because of their inability to control emotions, particularly fear and greed. Greed increases when investors read stories of huge returns being made in the stock market in a quick time. In a bear market, on the other hand, investors panic and sell their shares at rock-bottom prices. Thus, fear and greed are the emotions that should be avoided when investing, and investors should not to be guided by them. Also, invest only your surplus funds.

As a Shareholder, a person can participate in the company's growth and success through stock Price Appreciation and by earnings Dividends. Capital or price appreciation is an increase in the market price of your stock over time brought about by an increase in its potential value and the demand to buy its shares. The faster a company can grow, the faster its price can appreciate. Profitable corporations can also issue dividends, whether in cash or in additional shares of stock as a means for shareholders to share in their distributed profits. You should also treat investing in the stock market as a business. That means understanding your own profit and loss as well as the companies in which investments are made. For example, before investing in a company, ask yourself, "Is the company’s product or services improving, growing better than its competitors?"