Ngayong buo na ang loob mo na mag-invest sa stocks, ang susunod mong iisipin ay kung ano anong mga stocks ang iyong bibilhin. Ngunit papaano ba pumili ng stocks? Ano-ano ba ang mga bagay na kailangan kong malaman bago bumili ng stocks?

Papaano ba ang pagpili ng stocks?

Sa larangan ng investments, ang analysis o pagsuri ng stocks na bibilhin ay maihahanay sa dalawang klase – ang una ay ang tinatawag na fundamental analysis at ang pangalawa ay ang technical analysis.

Fundamental Analysis

Ang fundamental analysis ang tawag sa pagtingin ng stocks base sa mga datos sa financial statements ng kumpanya at sa iba pang mahahalagang aspeto nito gaya ng cash flow at relative valuation techniques. Dito sinusuri kung ang isang stock ba ay masasabing undervalued (mas mura sa presyo nito) o overvalued (mas mataas kaysa sa presyo nito).

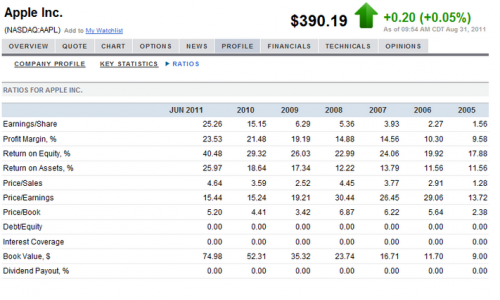

Ang konsepto dito ay ang stock price ay nakadepende sa kita ng kumpanya o sa financial status nito. Dito ay pinagbabasehan ang mga financial ratios ng kumpanya gaya ng P/E ratio, Book value per share, at iba na inihahambing naman sa mga competitors nito sa industriyang kinabibilangan nito.

Makikita sa ibaba ang isang halimbawa ng mga financial ratios na ginagamit sa pag-assess ng isang stock.

Source: www.barchartmarketdata.com

Sa pamamagitan ng fundamental analysis malalaman ang kasalakuyang estado ng kumpanya na makakapagbigay ng malaking senyales kung ang stock price ba ay tataas o bababa. Ito ay dahil madalas nakasalalay ang stock price at ang paggalaw nito sa kita at sa financial performance ng isang kumpanya.

Technical Analysis

Ang technical analysis naman ang bansag sa pagsuri ng stocks base sa mga charts nito at nakaraang paggalaw nito. Ang pananaw kasi dito ay sa mismong stock price na nakapaloob kung ano ang sentiment ng mga investors at ang market sentiment na ito ang makapagsasabi sa takbo ng stock price – kung ito ba ay tataas o bababa.

Makikita sa ibaba ang itsura ng isang chart at trend analysis nito. Dito mo makikita ang paggalaw ng stock price at ang paggalaw din ng volume nito.

Maraming mga senyales at patterns sa pagtingin ng stocks ang maaari mong ikonsidera upang masabi ba kung bullish o bearish ito.

Ang bullish market ay nangangahulugan na ang trend sa presyo ng stocks ay papataas. Samantalang ang bearish market naman ay nangangahulugan ng trend na pababa ang presyo ng stocks.

Napakahalagang aspeto ang pagtingin kung papataas o papababa ang stocks dahil sa pamamagitan nito malalaman mo kung dapat mo na bang ibenta o hindi ang stocks mo. Halimbawa nito ay kung si OFW ay bumili ng BDO na nagkakahalaga ng 96 pesos kada share noong nakaraang linggo. Kung ngayon ay nagkakahalaga na ito ng 105 pesos kada share, ibig sabihin nito ay may unrealized profit na sya na 9 pesos kada share. Maari nya nang ibenta ito kung gugustuhin nya at kikitain nya na ang 9 pesos (maliban sa fees sa pagbenta) mula rito.

Sa kabilang banda naman, kung ang presyo ng stocks ni OFW nung kanya itong binili ay nagkakahalaga ng 102 pesos kada share at ngayon ay nagkakahalaga na lamang ng 80 pesos kada share. Ang ibig sabihin nito ay may unrealized loss na sya na 22 pesos kada share. Sa puntong ito ay kinakailangan nyang i-assess kung patuloy pa bang bababa ang stock price nya. Dahil kung ito’y patuloy pang bababa at babagsak, magandang ibenta nya na ito upang maiwasan pa ang lalong pagkalugi.

Sa pagtukoy kung baba o tataas ang stock price kikita ang isang investor. Ito’y dahil kung mabibili mo ito ng mas mura at maibebenta mo ng mahal, magkakaroon ka ng gains. At sa kabilang banda naman, kung ito’y iyong mabibili ng mahal at maibebenta mo sa mas mababang halaga, ikaw ay magkakaroon ng losses o pagkalugi.

History has proven that investing in quality stocks can provide greater returns than most investment instruments. This offers an ordinary Pinoy investor, overseas Filipino worker the best chance in achieving financial goals and gives you the ability to later enjoy the benefits of their money.

Nevertheless, making money in the stock market (equities) is not easy. It not only requires a lot of patience and discipline, but also a great amount of research and a good understanding of the market, among others. Remember that you should always avoid following the crowd if you don't want to lose your hard-earned money in stock markets. The world's greatest investor Warren Buffett was wise when he said, 'Be fearful when others are greedy, and be greedy when others are fearful.' Don’t try to time the market. Catching the tops and bottoms is a myth. More people have lost far more money than people who have made money. A lot of investors lose money in stock markets because of their inability to control emotions, particularly fear and greed. Greed increases when investors read stories of huge returns being made in the stock market in a quick time. In a bear market, on the other hand, investors panic and sell their shares at rock-bottom prices. Thus, fear and greed are the emotions that should be avoided when investing, and investors should not to be guided by them. Also, invest only your surplus funds.

As a Shareholder, a person can participate in the company's growth and success through stock Price Appreciation and by earnings Dividends. Capital or price appreciation is an increase in the market price of your stock over time brought about by an increase in its potential value and the demand to buy its shares. The faster a company can grow, the faster its price can appreciate. Profitable corporations can also issue dividends, whether in cash or in additional shares of stock as a means for shareholders to share in their distributed profits. You should also treat investing in the stock market as a business. That means understanding your own profit and loss as well as the companies in which investments are made. For example, before investing in a company ask yourself, "Is the company’s product or services improving, growing better than its competitors?"

Sa susunod kong mga articles, aking ipapaliwanag ng mas detalyado ang konsepto ng fundamental analysis at ang mga ratios dito. Akin din pagtutuunan ng pansin ang tungkol sa relative valuation techniques at ang stock valuation.